We offer clients three benefits: save time, save money, and peace of mind.

Get started with a free consultation!

Get started with a free consultation!

Individual Tax Services

Business Tax Services

International Tax Services

E-commerce Tax Services

Hedge Fund

Don’t know how to handle foreign income tax issues?

What is FATCA compliance?

Stop worrying and seek professional advice

MHC Tax Service was established in 2001. We specialize in helping clients file tax returns and resolve tax issues over the phone or the internet.

We serve clients from all walks of life, including restaurants, food wholesale, transportation, construction, supermarkets, and other manufacturing industries. Service industries include law firms, child care centers, vocational schools, computers, and internet-related companies, etc.

In this rapidly changing world, we are constantly updating and improving ourselves so that we can provide the best quality solutions to our client’s tax issues. We understand the needs of our clients, and we use our best professional advice to provide assistance. From the establishment of a new LLC to the provision of accounting and tax services, these are the main services provided by our CPA firm. We are confident that with years of rich experience and a sincere service attitude, we will be able to provide clients with the most complete service.

陳厚成會計師事務所成立於2001年,專門通過電話及互聯網幫助全美50州和美國境外華人解決美國稅務問題。

我們所服務之客戶遍佈各行各業,有餐館、食品批發、運輸、建築、超市及其他製造業。服務性行業如律師事務所,幼兒中心、職業學校、電腦及互聯網有關之公司等。

在這瞬息萬變之社會裡,我們不停地更新及改進自己,以便客戶在遇到問題時能提供最優質之解決方案。盡力了解客戶之需要,再利用我們專業之意見提供協助是本行多年來之服務方針。由成立有限公司,至提供會計及稅務服務,皆是本行提供之主要服務。我們深信,憑著多年之豐富經驗,加上誠懇之服務態度,定能為客戶提供最完善之服務。

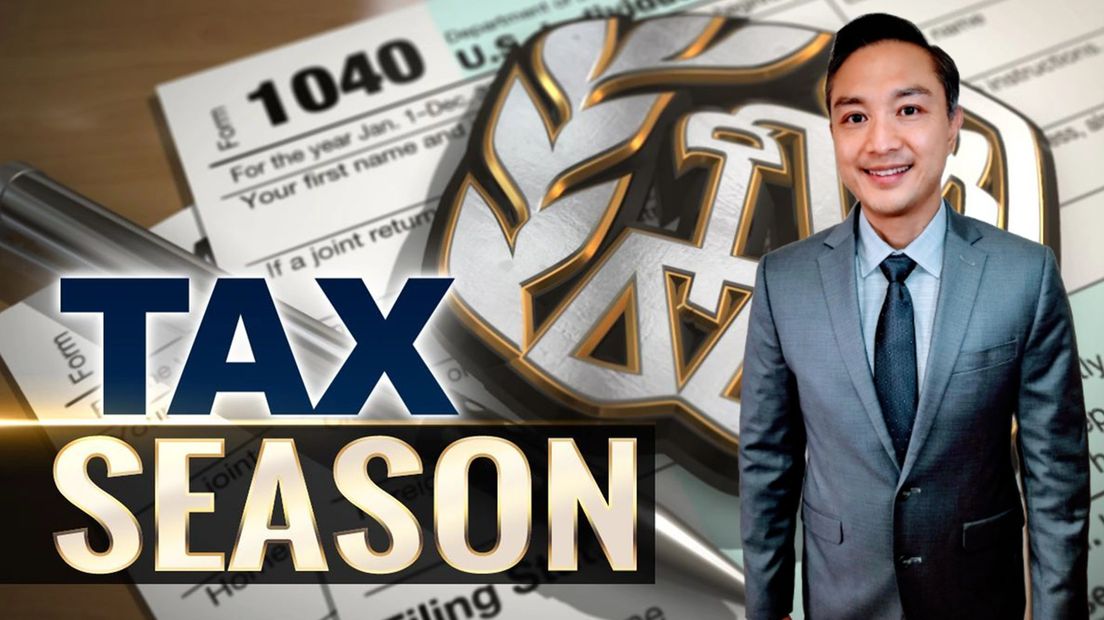

Founder Martin H. Chan, CPA

創辦人陳厚成註冊會計師

Speaking on the international tax issues

討論國際稅收問題

Speaking on the estate tax issues

討論遺產稅問題

Martin H. Chan, CPA, graduated from the Wharton School of Business in 1996. He worked for international accounting firms. Then he came to realize his true passion is helping small businesses to succeed. Since its inception in 2001, his firm has grown to serve over 5,000 individuals and small business clients.

陳厚成,註冊會計師,於1996年畢業於沃頓商學院 。在他的職業生涯初期,陳厚成曾在費城和紐約的國際註冊會計師公司工作。他的大部分工作都是為上市公司和高資產個人客戶服務。後來,他意識到他的真正志向在於幫助本社區的中小企邁向成功。在2001年,他創立了他的會計師事務所。 自成立以來,他已服務超過5,000個個人和小型企業客戶。

Federal and all 50 state tax filings

You can get professional help and guidance anytime and anywhere

We guarantee 100% customer satisfaction. If at any time, you find that any of our services are unsatisfactory, please let us know and we will immediately correct it to your satisfaction.

我們保證客戶百分百滿意。如果在任何時間,您發現我們的任何服務是不能令人滿意的,請告訴我們,我們會即時糾正,讓您滿意。

我們歡迎Zoom會議